Tax Time: Scavenger Hunt

Objective

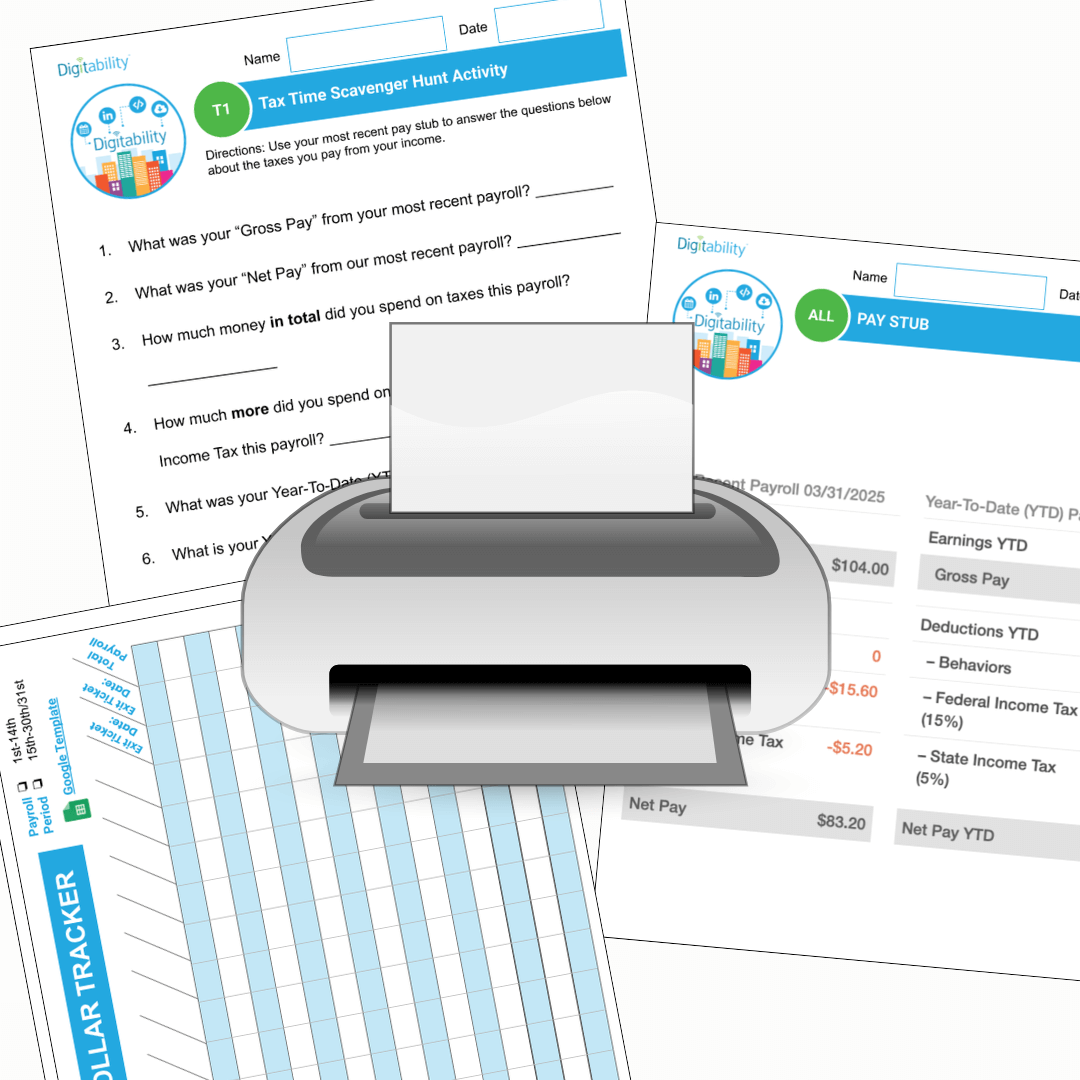

To begin the lesson, explain that everyone who earns income pays taxes, and those taxes help fund important services like schools, roads, and public safety. Students will explore this concept using their own Bankability pay stubs. After reviewing the difference between gross pay (the total earned) and net pay (the amount received after taxes), students will complete a scavenger hunt by locating specific details on their pay stub. They’ll use the information to calculate how much they’ve paid in taxes and reflect on how those deductions add up over time. This engaging, hands-on activity will help students better understand the impact of taxes on their income and build practical money management skills.

Directions for this Extension Activity:

In this activity, students will use their Bankability pay stub to understand taxes. Students will review their pay stubs and distinguish between gross pay and net pay. Using their scavenger hunt form and Bankability pay stub, students will apply their payroll information to complete their scavenger hunt.

Duration: ~15 minutes* [will vary based on students' level of need]

Digitability Curriculum Concepts: Financial Literacy, Communication, Social Skills

Incorporating Bankability:

For current Bankability users, this activity reinforces key concepts of earning, spending, and saving using real data from students’ pay stubs. Students can also earn additional participation dollars for staying on task and completing their scavenger hunt. If you're not yet using Bankability, click here to learn how this program can support your students' financial literacy and transition goals.

Get Your FREE Quote Today!

You may also be interested in...