Midpoint Check In

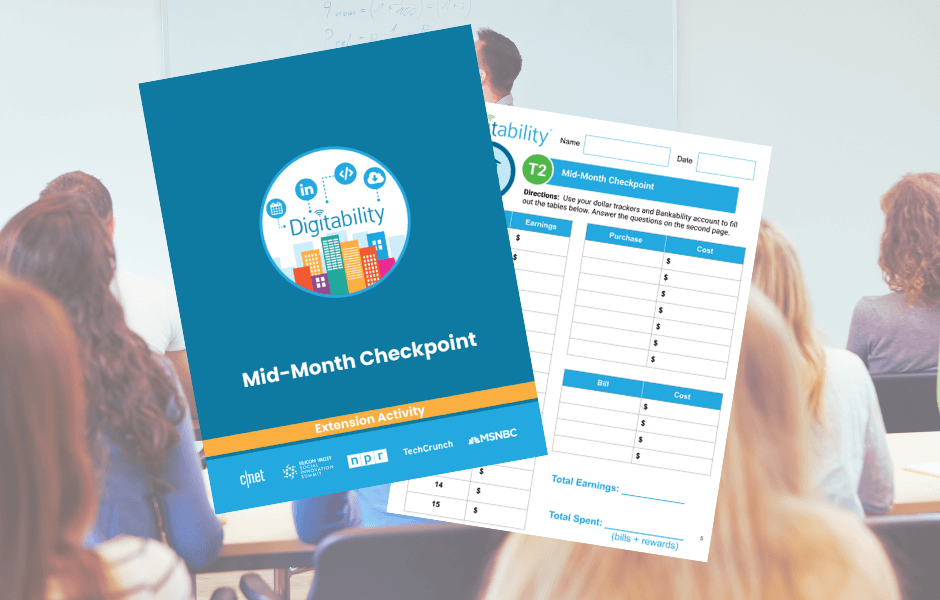

Objective

Students will demonstrate their financial literacy skills while building self-awareness skills through this activity. By calculating their earning and spending habits throughout the month, students will be able to track actually earning and spending and compare to their budgeted allowances. Students will then build communication skills as they share their findings with their peers.

Directions for this Extension Activity:

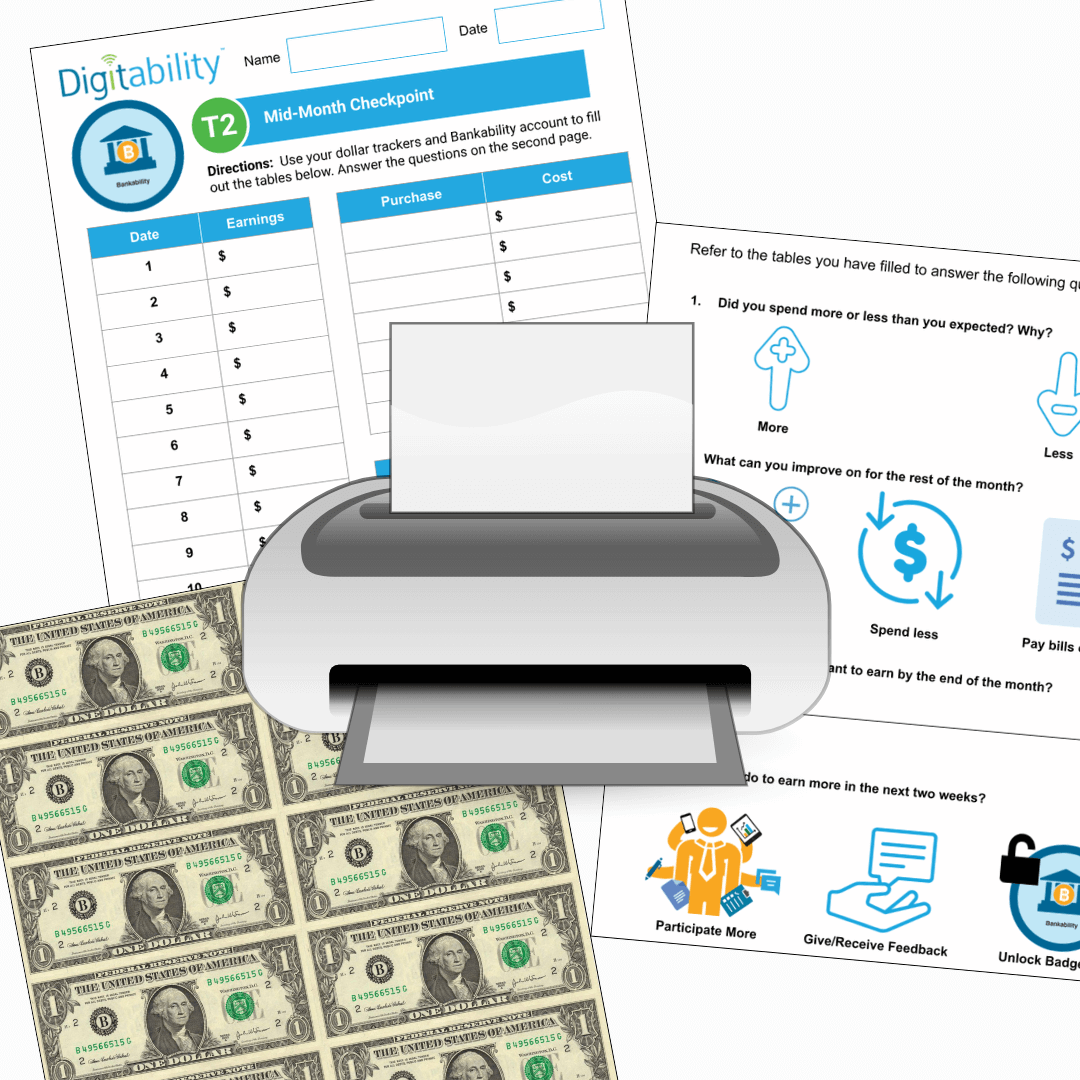

In this activity, students will increase their budgeting skills by calculating totals for their behavior earnings and spending on bills and rewards. Students will calculate earning totals for successful behavior and spending totals on bills, rewards, and problematic behavior. Students will then reflect to determine if they are on track to reach their monthly goals.

Duration: 15 minutes* [will vary based on students' level of need]

Digitability Curriculum Concepts: Financial Literacy, Communication, Social Skills

Incorporating Bankability:

Throughout this activity, students can earn dollars for logging all their spending and earning, calculating totals, and sharing their findings. This encourages participation, positive behavior, and peer support. Current Bankability users can integrate these earnings into their classroom economy. No Bankability account? Use the templates provided and click here to learn more about bringing Bankability to your program.

Get Your FREE Quote Today!

You may also be interested in...