End of Year Highlights

Objective

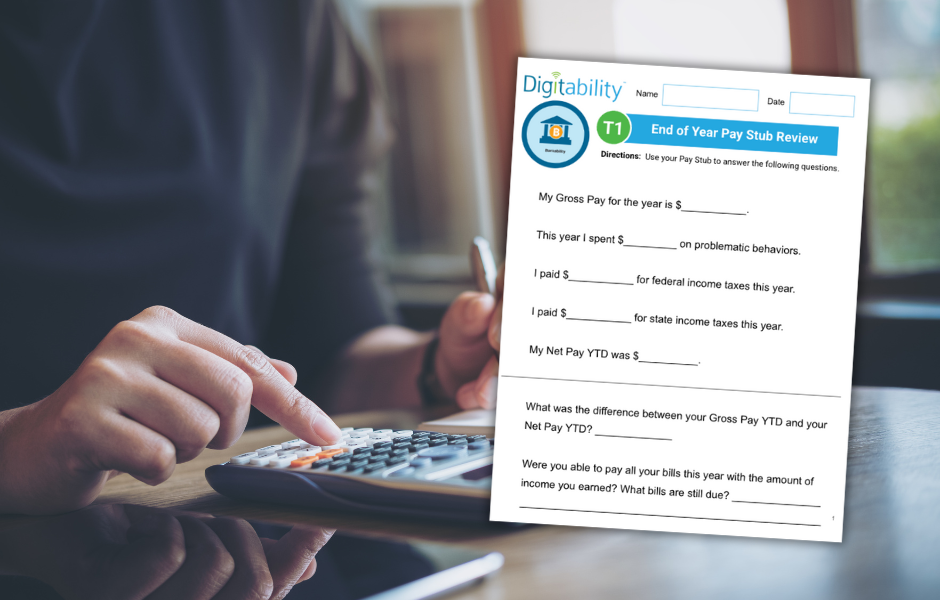

Students will build financial literacy and workplace readiness by engaging in an interactive Pay Stub Review activity. Using either their personal pay stubs or a provided sample, students will learn how to read and interpret key sections of a pay stub, including gross pay, deductions, taxes, and net pay. Students will analyze how earnings and deductions impact take-home pay, recognize common payroll terms, and reflect on how income relates to budgeting and financial goals, strengthening their ability to make informed decisions about their earnings and personal finances.

Directions for this Extension Activity:

In this activity, students will analyze and reflect on their most recent pay stub to better understand their earnings, deductions, and tax contributions. Students will identify and define key pay stub terms while reviewing their year-to-date earnings. They will calculate the difference between gross pay and net pay to see how deductions impact take-home income. Finally, students will respond to questions connecting their income to budgeting, financial goals, and real-life money management decisions.

Duration: ~15 minutes* [will vary based on students' level of need]

Digitability Curriculum Concepts: Financial Literacy, Communication, Social Skills

Incorporating Bankability:

Throughout this activity, students can earn dollars for staying on task, completing the “End of Year Reflection” form, presenting to the class, and helping their peers during the activity. This encourages participation, positive behavior, and peer support. Current Bankability users can integrate these earnings into their classroom economy. No Bankability account? Use the templates provided and click here to learn more about bringing Bankability to your program.

Get Your FREE Quote Today!

You may also be interested in...